Some Known Details About Pkf Advisory Services

Table of ContentsThe Ultimate Guide To Pkf Advisory ServicesAll About Pkf Advisory ServicesThe Single Strategy To Use For Pkf Advisory ServicesSome Of Pkf Advisory ServicesSome Of Pkf Advisory ServicesGetting My Pkf Advisory Services To Work

When it comes time for an evaluation, it is vital for entrepreneur to be clear on: What is being valued or appraised Why the valuation/appraisal is taking place What sort of evaluation professional must be doing the work If owners are unclear concerning this they will certainly finish up with a useless record, wasting valuable time, energy, and money.The objective of the evaluation constantly educates the technique, and as a result the capability you'll want the evaluation solution supplier to have. Some appraisal experts do it all while others do not implying, some analysts supply comprehensive valuations, while others focus on a certain niche. Local business owner need to be explicit concerning what they are looking to obtain out of the appraisal.

Many will certainly not, or will certainly charge additional charges to do so. Some valuation experts concentrate on certain valuations that wind up in litigation. Below is a breakdown of the numerous kinds of evaluation solutions you might encounter and that they are best suited for. Throughout an industrial realty assessment, specialists will value real estate possessions such as land and buildings.

The Pkf Advisory Services PDFs

While it is necessary to the company, the firm would be able to go on without it. Employees might function from home and the owner can locate a new workplace with a little bit of research study. Contrast this to, state, a hotel, where 100% of the firm's earnings depends upon the structure remaining functional.

The Facts About Pkf Advisory Services Revealed

There are specialists for this type of assessment. Unlike various other appraisals and appraisals, which evaluate concrete possessions, a copyright (IP) appraisal takes into consideration abstract possessions. These can be especially beneficial to assist entrepreneur identify the fair worth of their firm and IP assets. There are specialists who supply these sorts of service assessment services.

The report is normally provided by the appraisal specialist, allowing the owner to why not try here ask concerns and get information. Once again, the secret is to obtain excellent details based on the function of the assessment, and exactly how the owner (and others) may require to use it.

The Definitive Guide for Pkf Advisory Services

Proprietors should do their due persistance and select a specialist who can give great details based on the objective of the appraisal. Economic market participants use evaluation to identify the cost they are prepared to pay or receive to effect a service sale. In its simplest kind, business appraisal can be seen as a procedure to identify the worth of a firm based on its assets, earnings, market placement, and future revenues potential.

Significance of Organization Valuation for Proprietors, Investors, and Stakeholders For company owner, understanding the worth of their company is critical for making notified choices regarding its sale, expansion, or succession planning. Capitalists use valuations to assess the possible success of buying a business, helping them make a decision where to allocate resources for the very best return on investment.

This source will certainly furnish you with an essential understanding of company appraisal, its value, and comprehensive info to think about if you need to work with an appraisal specialist. Homepage Recognizing the nuances of various appraisal metrics is crucial. Below's a breakdown of four core ideas: fair market price, financial investment value, innate worth, and publication worth, along with a discussion on importance.

Pkf Advisory Services - An Overview

The reasonable market price basic uses to nearly all federal and state tax matters and separation situations in several states. Meanings and applications might differ in between territories. This requirement of worth describes the value of a possession or organization to a specific customer or vendor. In contrast to the "theoretical" customer or vendor presumption used under fair market worth, the investment value standard thinks about the owner's or buyer's knowledge, capacities, expectation of dangers and making potential, and various other aspects.

This requirement of worth is often used when valuing a company being taken into consideration for potential purchase. Inherent value is the value inherent in the property itself. While financial investment value is extra reliant upon qualities sticking to a specific buyer or owner, innate worth represents a quote of worth based on the viewed features of the financial investment itself.

(It should be noted that Virginia instance law recommendations "innate worth" as the appropriate requirement for separation. The meaning of the term in the situation regulation varies from that offered right here). Fair worth is the standard of value for sure kinds of shareholder litigations, such as shareholder injustice and dissenting civil liberties instances.

As necessary, the value of a particular ownership rate of interest under this requirement of value can be Read Full Article considered as the worth of the according to the calculated share rate of interest in the complete value of a business's equity. Its interpretation can differ from state to state, so it is critical to understand the laws and pertinent case law for the state.

3 Easy Facts About Pkf Advisory Services Explained

A business valuation offers a precise estimate of the organization's well worth, assisting to set a reasonable price that mirrors the business's value. It ensures that the proprietor does not undervalue the organization or set an unrealistically high cost that prevents potential purchasers (PKF Advisory Services). Companies looking for to elevate capital via equity financing require to understand their company's value to determine exactly how much equity they have to surrender in exchange for financial investment

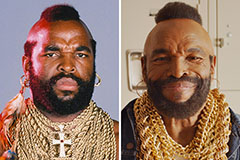

Mr. T Then & Now!

Mr. T Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!